W9 and TIN Guidelines

Jenni

Last Update 2 maanden geleden

This article can help resolve the following issues:

- My W9 was rejected. How do I find out why?

- How do I properly fill out my W9?

- My TIN did not pass the TIN check, what do I do?

- My W9 was rejected for a TIN error, what does this mean

If your W9 was deemed non-compliant, you can see why by logging into your account.

Next to your W9, it will say "Tin Check Failed." You can click this to see more details:

If it was rejected by a team member, there will be reviewer notes stating why:

Some common reasons our team might reject your W9 are:

- It was not signed

- It was not dated

- You provided two TINs (we can only accept one)

- The document is difficult to read

- There is correction tape or items crossed out

- You did not check off a tax classification

- You checked off multiple classifications

- You check off that you are an LLC but didn't denote classification

W9's processed by our team are then run through a TIN check with the IRS. If your TIN check is returned with "Issues Found," it will appear like this when you click "Tin Check Failed:"

There are many different results that can appear here. If you have questions about your TIN Check Results, please reach out to us.

Here are a few common reasons why an issue may be found:

- Incorrect TIN: Double-check the EIN or SSN you provided on the W9 form. Even a small typo of numbers can result in a bad TIN check.

- Two TINs: Do not provide both an EIN and an SSN on one W9 form.

Name - TIN Mismatch: Please ensure the name you provided on the W9 form matches the name associated with the TIN.

In general, if you have an EIN (employer number) as your TIN, there should be a business name in Line 1. If you only have an SSN (individual social security number), you should put your name in Line 1. There are exceptions but this is the general rule.

- Must be signed and dated: Please make sure you date and sign the form with wet signature or e-signature. A plain typed name is not acceptable.

- Ensure your W9 is signed and dated.

- Ensure you have entered a TIN (and only one - EITHER your EIN or your SSN but not both)

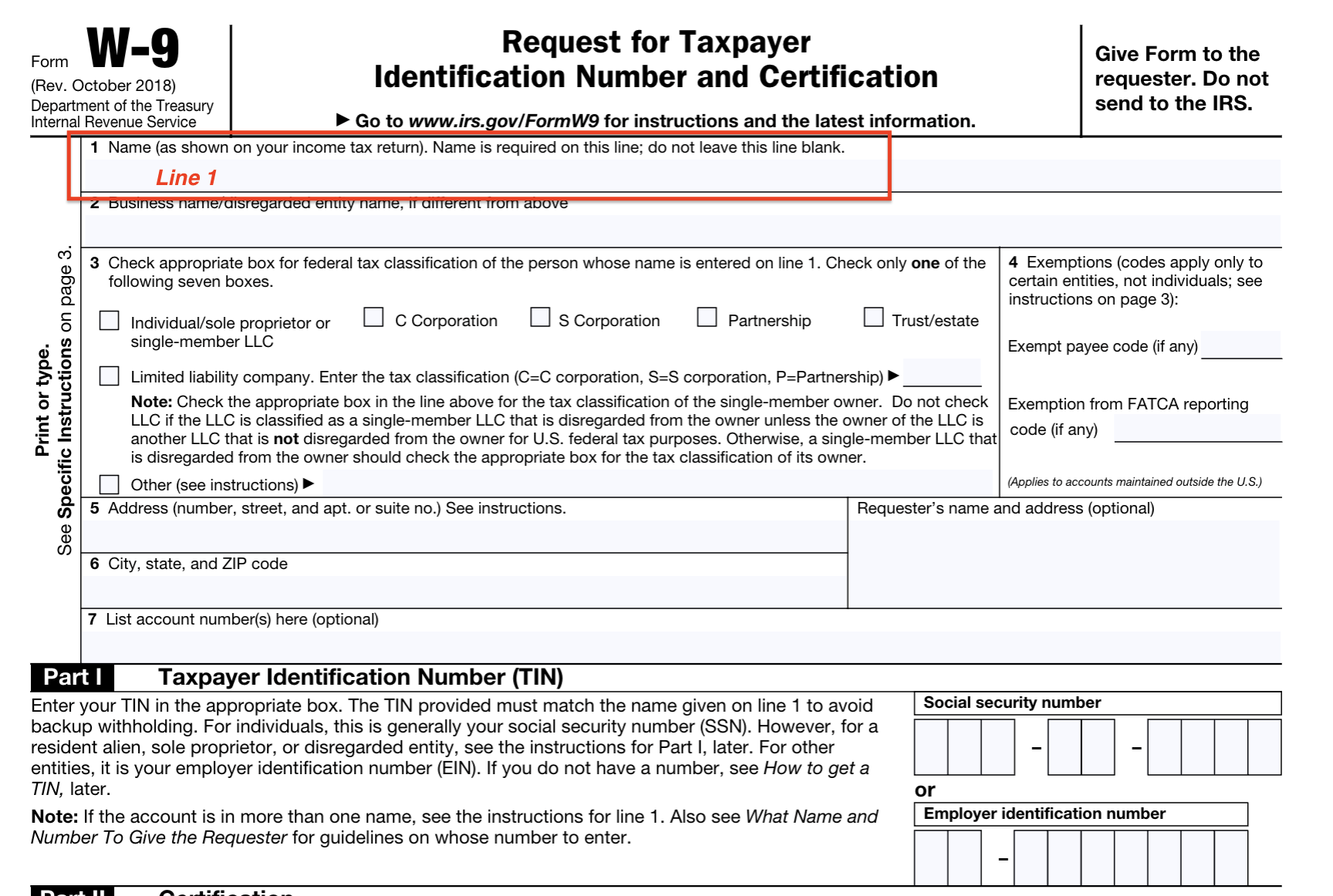

- On line 1: Enter the name your business pays taxes under.

Begin by entering your name exactly as it appears on your tax return associated with the Taxpayer ID number. If you and your business pay taxes separately, do not put your individual/personal name here! Put your LLC name here if you have one.

This line must be filled out or the document will be rejected.

- On line 2: Enter the disregarded entity or DBA business name - only if different from Line 1

- If you are operating under a different business name, for example a DBA, enter it here. This line is not required.

- On line 3 /3(a): Choose your business federal tax classification.

- You must select one of the following boxes:

- Individual/Sole Proprietor

- C Corp

- S Corp

- Partnership

- Trust/estate

- Limited Liability Company

- Other

- You cannot check more than one box.

- If you are a Limited Liability Company, please be sure to enter your classification C, S or P in the box to the right, where red arrow is pointing at (see image below)

NOTE: If you are using the March 2024 W-9 form, please see Line 3(a) - see image 2

Why did my TIN check came back as No Match Found?

If the IRS tells us there was "No Match Found," there is a mismatch between the name in Line 1 and the type of EIN you provided.

We verify your TIN with the IRS using the name provided in Line 1. We frequently receive a note back from them that there was no match found. This is nearly always due to someone providing their personal name in Line 1 but using a business TIN (EIN).

Double check your W9 to make sure you are providing a business name in Line 1 if you provide an EIN - unless you have a specific situation that you are aware of that requires otherwise. For most people, this guideline is enough.

We will run the TIN (Taxpayer Identification Number) check process using the EIN (Employer Identification Number) or SSN and whatever is in Line 1 of the form. Please enter the name as shown on your business's tax return on line 1.